Pay Your Rates Online

Water Rates

Q1 2025/2026 rates invoicing delay

The rates for the 2025/2026 rating year were confirmed with the adoption of the Annual Plan 2025/2026 at the Council meeting on 25 June 2025. The rating year goes from 1 July 2025 – 30 June 2026 with your first instalment due on 20 August 2025.

Rates payments

Please email us at revenue@kaipara.govt.nz to discuss any payment options.

Ratepayer newsletters

Ratepayer newsletters are sent out with every rate instalment notice and are also available here.

How do I find out more about rates for my property?

We keep a detailed record of rating information for Kaipara District and Northland Regional Councils. To use the Property and Information search tool you will need:

- Valuation number, property address or property legal description.

This will provide you with information about your annual rates and rateable values.

Alternatively you can contact us.

How does the Council calculate my rates?

How much you pay in rates depends on:

- The valuation of your land, when compared with the other land values in the district. Land values were updated on 1 September 2023 and will affect the proportion of rates you pay.

- How the land is used – there are different rates for residential/small sized lifestyle properties and an ‘other’ category, which includes land used exclusively, or almost exclusively for dairy, horticultural, forestry, pastoral and specialist purposes, commercial, industrial or mining purposes and as a utility asset.

- Where the property is located and if targeted rates apply - This can include stormwater, wastewater, water supply, and other targeted rates.

- Whether a portion of Capital Contribution to the wastewater system is remaining - (for some Mangawhai properties).

- Northland Regional Council (NRC) Rates – There are changes to the NRC rates for this year that may have an overall impact on your total change. NRC sets their rates through their own Long Term Plan, and Kaipara District Council collects them on their behalf.

- Council's work programme which funds things like roading, wastewater, drinking water supply, drainage, libraries, facilities, playgrounds, sports fields, and their ongoing maintenance (e.g. planting and safety upgrades).

Rates invoices

Rates invoices are sent to the property owner. We post your invoices by default as required by law.

You can sign up to receive your rates by email instead.

Rates penalties

Contact us to discuss payment options if you are not able to pay your rates in full.

You can pay now by direct debit or over the phone with credit card. Call 0800 727 059.

If you do not pay your rates instalment in full you will receive a penalty of 10% for any amount that is overdue after the following dates:

|

Instalment Number |

Penalty Date |

| Instalment One | 21 August 2025 (10%) |

| Instalment Two | 21 November 2025 (10%) |

| Instalment Three | 21 February 2026 (10%) |

| Instalment Four | 21 May 2026 (10%) |

You won't be charged a penalty if you enter into a payment arrangement by direct debit and honour that arrangement.

On 3 July 2025 you will also be charged a 10% penalty for any part of the rates from previous years that have not been paid by 2 July 2025. On 6 January 2026 an additional 10% will be added to any balance still remaining unpaid as at 5 January 2026.

For water by meter rates, a penalty of 10% of the amount outstanding on each bill will be added after the due date.

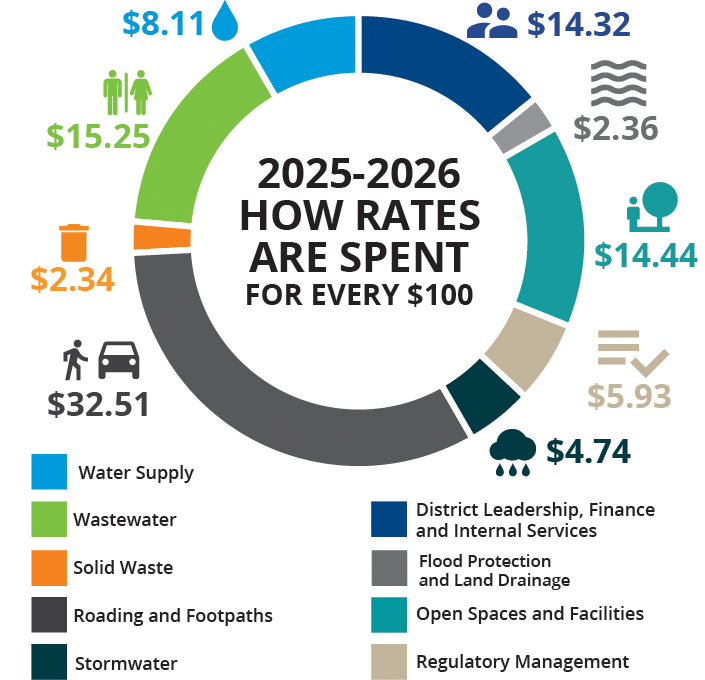

What are your rates used for?

For the 2025-2026 year, here is a breakdown of what your rates pay for (per $100).

When are my rates due?

The rating year is 1 July to 30 June and is divided into four equal instalments, each invoiced separately. Throughout the year, you will receive four rates invoices, one every three months.

Instalment Number Due Date

Instalment One 20 August 2025

Instalment Two 20 November 2025

Instalment Three 20 February 2026

Instalment Four 20 May 2026

Rates rebate?

If you are on a low income you may be eligible for a rates rebate, and have part of your rates paid by the Government.

Find out more at the Department of Internal Affairs or use this Rates Rebate Calculator.

Rates remission and postponement schemes

Rate remission and postponement schemes may:

- Provide financial assistance and support to ratepayers

- Address rating anomalies

- Address matters related to wastewater charges

- Cover other objectives.

Talk to us to find out more: email revenue@kaipara.govt.nz or telephone 0800 727 059.

Solicitor rates requests

Solicitors should complete a Solicitors Settlement Request Form.

How can I pay my rates?

Our bank account details are:

Account Name: Kaipara District Council

Bank: Bank of New Zealand

Account Number: 02-0308-0090743-07

If you are paying:

- Land rates - please quote your valuation number

- Water rates - please quote your customer number.

If you are paying from overseas:

Bank Swift Number

Bank IBAN Number NZ020308009074307

Payments can be made:

1. By direct debit. The easiest way to pay your rates is by Direct Debit. You can choose to pay weekly, fortnightly, monthly, quarterly or annually. Download forms for:

Send your completed forms to revenue@kaipara.govt.nz or Kaipara District Council, Private Bag 1001, Dargaville 0340.

2. By online banking - Account Number: 02-0308-0090743-07. If you are paying

- Land rates - please quote your valuation number

- Water rates - please quote your customer number.

3. By credit card or debit card online, MasterCard and Visa only. The Bank of New Zealand charge you a convenience fee of 2.10% per transaction for this service (with a minimum fee of $1.00 per transaction).

4. By automatic payment. Download the automatic payment form. You will need to update the amount paid every year. Note that if the balance owing is not paid by the due date you will incur a penalty.

5. In person (EFTPOS, MasterCard, Visa or cash). Rates payments will be accepted during normal business hours at either of the two Council offices.

You can pay your rates for the current year in full on or before the due date for the first instalment of the year. There is no discount available for early payment.

Any rates payments due will be credited first to the oldest amounts due.